TEXT MARÍA JESÚS PÉREZ FUENTES | PHOTOGRAPHS MAPFRE | ILLUSTRATIONS ISTOCK

The work that Deniz, Sandra, Fernando, Mercedes and Ronald are tasked with in MAPFRE is intrinsically linked to our Client Orientation strategic pillar. This is because, among other things, their job entails cultivating the relationship with the intermediaries and brokers who distribute MAPFRE insurance policies all over the world.

MAPFRE has been committed for years now to an omnichannel distribution model and top- flight customer service, two aspects that define our activity. The MAPFRE Global Agency Network Development Model was designed in 2017, serving to provide a major boost to the creation of our own network. In 2018, it was complemented with the Direct Office and Delegate Office Models. In addition, the Group has entered into agreements with banks and financial institutions in several countries, as well as with service companies and associations that distribute MAPFRE products to their clients and partners (firms or individuals). As well as its own network, MAPFRE also maintains a close relationship with intermediaries and brokers, representing as they do a highly significant part of the worldwide distribution of our insurance policies. And this is where our Leading Actors come in.

Deniz joined MAPFRE SIGORTA in 2013. Just like her colleagues, most of her daily work is spent in visits or meetings with brokers. In a job like this, it is just as important to have the pertinent technical knowledge, as it is to possess interpersonal skills that facilitate the task of empathizing with clients and colleagues. “You need to have fine communication skills, a good understanding of consumer requirements, and be approachable and persuasive with ample sales technique know-how,” she specifies. Together with her colleagues, she has seen to it that the brokers who work with MAPFRE in Turkey have an excellent opinion of the company, which they consider “readily approachable”.

Mercedes, from MAPFRE COLOMBIA, insists on the importance of brokers possessing extensive technical knowledge of the line they are selling, “but also on the need for a good commercial relationship and negotiation tools to close the deal.”

Fernando is the newly appointed manager of the Brokers Channel at MAPFRE España and agrees that, in this job, no day is like any other, because, as he himself defines it, “it’s an adventure every day.” “I have to make myself available to whoever needs me:brokers, broker service offices, the team at Headquarters, dealing with coordination with the other channels, sales and technical areas, providers…”

“I prepare quotes for collective accounts and hold meetings with brokers for sales strategies or closing corporate accounts,” says Sandra, from MAPFRE COLOMBIA. “I monitor the full cycle through to closing to ensure the full involvement of all the service and after-sales departments. Moreover, I give talks on benefits to corporate healthcare companies.”

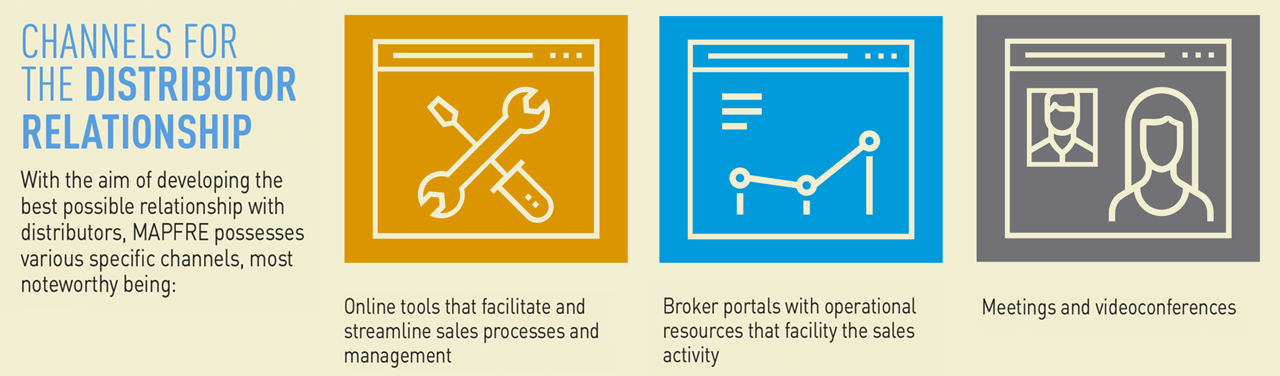

As in any other sphere of society, technology is also a key element in the evolution in the insurance sector. In the case of Turkey, Deniz explains the major difference introduced by having a digital platform on which the brokers can easily access the full range of products and detailed information on each of them. “It’s much easier to get insured now. Today, with the impact of digitization, online sales of individual policies have increased significantly,” she tells us. “The main competitive edge MAPFRE has is its wide range of products, the direct communication with brokers, accessibility and the applications to rapidly obtain quotes via our websites, from where the insured can easily access details of the claims process or any other type of information they require.”

“MAPFRE is making unprecedented strides in its technological development for the world of the brokers,” states Fernando. “And, technology undoubtedly helps brokers generate added value when advising on products, or indemnity settlements in the event of a claim,” adds Mercedes.

Currently, MAPFRE ESPAÑA is deploying the Digital Brokers Portal, sure to be a fundamental solution when it comes to managing all of MAPFRE’s business. The platform will make it possible to interconnect all the brokers, which will be of great help in the development of MAPFRE’s business in Spain.

The transformation in which MAPFRE is fully immersed, as a fundamental, transversal pillar of the Strategic Plan for 2019-2021, calls for agile, flexible structures that, among other things, allow us to keep one step ahead of the competition. This also requires contact with – and the support of – the brokers, “a micro insurance market in themselves,” as Fernando, puts it, “who have access to the solutions introduced by our competitors.” “From the privileged market position we hold, we must be willing to learn more about those areas we have started out on later than many of our competitors.”

Ronald, from MAPFRE INSULAR (Philippines), is responsible for supervising and coordinating the performance of his unit, and the brokers associated with it. “I’m in contact with our Branch Head and I keep them informed of our production.” In the Philippine market, those companies that have embraced the digital transformation are conducting their operations with great risk management efficiency, “which enables them to manage risks and predict customer needs more efficiently.” “The change has come and the new technologies affect the way you interact in the marketplace and how insurance companies communicate with their clients, which has led to a process of disintermediation,” he stresses.

As a future challenge, Mercedes points to the evolution of the broker’s profession toward comprehensive, professional consultancy, “because that’s what the client requires in the full context of their needs, both as regards employee benefits and the firm’s need for certain insurance policies in order to be adequately covered, according to their specific requirements.” For her part, Sandra expresses a more concrete desire: “to be the number one insurer in the Region.” “We have to come up with a new value proposition for the brokers that can bring us closer to them, that makes it easier for them to work with us,” Fernando concludes, “(…) because, in the end, what we must aim for is that, thanks to tools that facilitate management, the brokers want to offer MAPFRE products, as they are certain that we are going to facilitate all aspects throughout the life of the policy, while respecting their position as intermediaries.”

Intermediaries and brokers, a valuable pillar of the industry

Daniel Meilán Assistant General Manager, Corporate Business & Clients/Non-Life Business and Channels Area

The Brokers Channel is fundamental for developing business in the insurance industry. When we speak of brokers, we are referring to a mediation that, in many cases, is focused on a segment of clients with a tremendous need for advice on their insurance plans, such as, for example, the Commercial Lines Client. In this sense, the brokers have teams which specialize in the various specific insurance needs of clients, such as property, liability, employee benefits, automobile fleet management, surety, transport, aviation, maritime, etc. They can even reach such a level of specialization that they only work on certain business lines and are closely linked to the principal insurance and reinsurance markets.

The brokers have tackled the international expansion of their business, and we find that some of them have offices outside their home markets. These may be branch offices or they may even form part of networks together with other brokers, which enables them to accompany their clients wherever they may be and offer more global services.

Like all of us in this industry, the brokers are also facing the challenge of adapting to the new times, to the era of the digitization of operations, distribution and customer service. Clients are now demanding top-priority attention and first-class quality, via whatever channel they may choose.