A platform to also be leaders in Insurtech

In MAPFRE, with our commitment to innovation and our customer-centric approach, we wish to play a pivotal role in this new digital era.

We must start from a very important premise: innovation has always been one of MAPFRE’s greatest strengths. If this company has managed over the last few decades to become what it is today, this is because, for a great many years, we have proved capable of offering our customers a great service with which they felt highly satisfied and could not find with our competitors. And we achieved this by improving processes and introducing concepts now widely adopted such as “insurance as a service” or “customer experience”, which we have been refining for many years now: we anticipate the needs of our customers; we integrate solutions; and we create efficient processes that enhance customers’ perception of the quality we offer. We were already innovating long before innovation became fashionable.

Innovation forms part of MAPFRE’s DNA

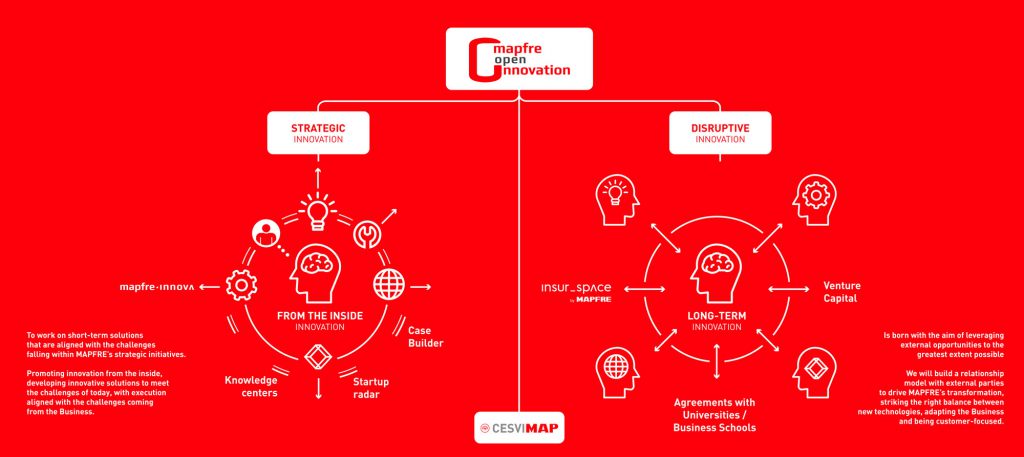

But the rate at which changes currently take place means that we must increase our efforts in order to adapt to this new environment and accelerate MAPFRE’s transformation. For this reason, we decided to go one step further this year with the launch of MAPFRE Open Innovation, an innovation platform created with the aim of becoming a tool for creating innovative solutions related to the insurance industry. Open to all new ideas, we can thus continue providing the best possible service, which is what our customers demand of us. MAPFRE Open Innovation, or MOi, combines the innovation that has always existed in MAPFRE – and which we define as strategic – with the development of a new space for disruptive innovation.

Our objective with MOi is to become a world reference in the field of insurtech innovation. To this end, we are setting aside over 100 million euros annually for the development of projects that are innovative or linked to digital business. Together with the 600 million-plus annual investment in technology, this will provide the company with significant capacity to take on these new challenges, as well as those related to transforming our value proposition.

Our goal with MOi is to maintain the position of our company as a leading insurance company, moving toward new business models and solutions that arise from the digital and technological changes we are currently experiencing. Why open? Because it was created with the mission of making the most of both internal and external ideas.

External innovation can generate value and with our internal resources we can capture part of that value. To coordinate this platform, a Transformation & Innovation Committee has been created. Headed by MAPFRE’s Chairman and CEO, it will establish the steps to be taken, the most relevant projects and their execution. At the helm of the MOi initiative is José Antonio Arias, our company’s chief innovation officer.

For the development of this strategic innovation, which is led by Miguel Ángel Rodríguez Cobos, we can count on a structure of innovation offices from MAPFRE’s principal businesses and areas. These will now be joined by transformation projects promoted by knowledge centers, agile innovation methodologies and the firm commitment to intrapreneurship, with MAPFRE Innova.

We have also incorporated CESVIMAP into the MOi. For many years now, our Experimentation and Road Safety Center has been a global benchmark when it comes to researching methodologies for the repair of vehicle damage sustained in traffic accidents. Its inclusion represents an opportunity to set itself apart as a MAPFRE R&D center for all things associated with the insurance business and automobilerelated services, as well as personal mobility questions.

The disruptive innovation model is headed by Josep Celaya. It consists of three core building blocks:

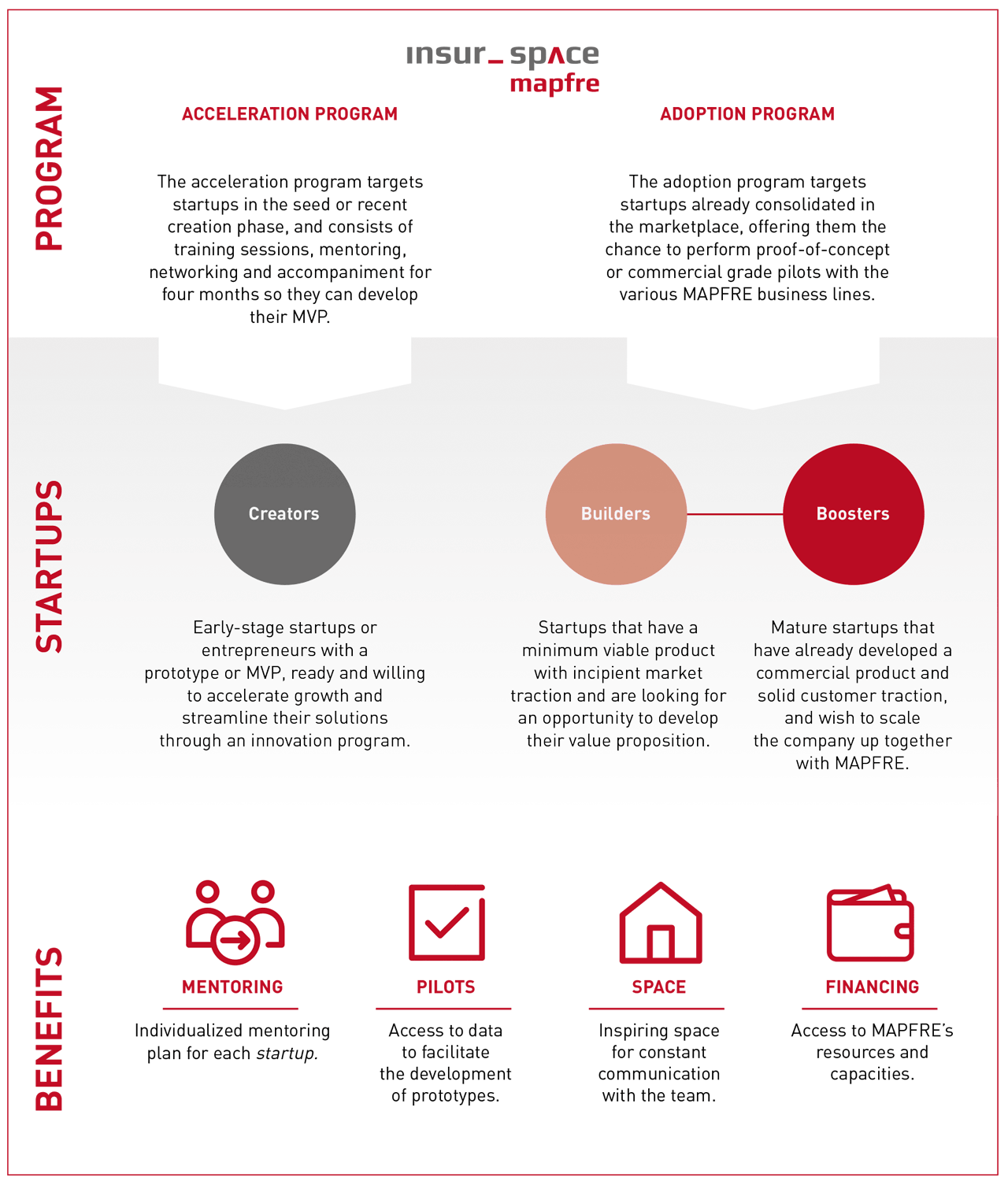

• Insur_space. The startup accelerator we opened recently in Madrid, which is already collaborating with nearly twenty startups for the launch of business models linked to the insurtech environment.

• An investment vehicle to participate in venture capital companies dedicated to innovation related to the insurance world, which has just started operating: we have announced the incorporation of MAPFRE as an anchor investor in the “Alma Mundi Insurtech Fund, FCRE” venture capital fund, exclusively focused on the insurtech field. Our participation amounts to 25 million euros and the fund is open to other institutional investors.

• A collaborative model to jointly develop innovative projects with Universities and Business Schools.

In short, with MAPFRE Open Innovation we are advancing to position ourselves in the insurance industry that is already a reality, not something coming in ten years’ time. We will thus be closer to our more digital customers; we are going to enhance our user experience, leveraging the technological advances and interacting with other sectors, profiles, technologies and models that exist in the market today.

3 QUESTIONS FOR JOSÉ ANTONIO ARIAS, MAPFRE’S CHIEF INNOVATION OFFICER

What are the principal challenges insurance faces in the coming years?

What are the principal challenges insurance faces in the coming years?

Success will be determined by being able to anticipate – and, above all – materialize ideas. For example, in the automobile sector, we are increasingly talking – and will keep talking – more about mobility and less about owning a vehicle. Or in the services sector for businesses and industries, we will witness growth of the related industry throughout the production and distribution chain, and the adaptation of insurance coverage, demonstrating the ability to accommodate business needs practically in real time.

Why has MAPFRE launched an innovation model like MOi?

Because we’ve always been guided by the same principle when it comes to innovating: create value for our customers. What happens is that the pace and conditions of the change this technological revolution entails have made us think that we’ll get better results – and these will be achieved sooner – if, in addition to using our own capabilities, we prove able to align and learn to live with the new startups and their Insurtech business models.

What goals have been set for improving the customer experience?

From the innovation standpoint, we are working on responding to the challenges characteristically posed by customers these days: immediacy, omnichannel distribution and an appetite for ever more personalized products. In MAPFRE, advances in digitization have mainly brought about three transformations: how our customers engage with us; the way in which our processes are executed; and the way we make the service offered by our providers available to those insured with us. With the MOi we’re going to improve our customer knowledge, listening and giving them continuous opportunities to tell us what they perceive. So we’ll transform the manner and frequency with which they come into contact with us and, indeed, use the services that are not limited by the cover options taken out.

In this 360º video you can see the interior of the insur_space

Insur_space opening video