The six leading actors in this issue belong to MAPFRE’s Corporate Investment Area, where decisions are made each day that directly affect the progress of the Group. Among other functions, our colleagues are responsible for finding the most suitable investment options for MAPFRE’s business and assessing all the alternatives, taking into account those that offer the greatest returns and allow money to be recovered as quickly as possible.

TEXT MARÍA JESÚS PÉREZ FUENTES | ILLUSTRATION THINKSTOCK | PHOTOS MAPFRE

Juan Luis and Mabel, our first two leading actors, work for MAPFRE Inversión Sociedad de Valores, one of the two pillars of the Investment area. Juan Luis is engaged in the supervision and control of the investment portfolios of MAPFRE Group international subsidiaries. For her part, the main task Mabel deals with is liquidating the operations undertaken by her colleagues at MAPFRE AM on both domestic and international markets.

Beatriz, Daniel, Cristina and Luis, belong to the asset manager pillar of the corporate area, MAPFRE ASSET MANAGEMENT (MAPFRE AM), formerly known as MAPFRE INVERSIÓN DOS. MAPFRE AM is the MAPFRE Group company specializing in financial investment management. The assets managed amount to some 40 billion euros. It started operating in 1989 and currently manages over 5.8 billion euros in mutual and pension funds on behalf of 311,000 clients, as well as the portfolios it handles for the Group.

The firm’s objective is to strengthen the global management of MAPFRE Group investments and prepare the plan to boost the management of third-party assets, so as to take advantageof sales opportunities as they arise. In July 2016 the change of name to MAPFRE AM marked the start of a new project, under the leadership of José Luis Jiménez, corporate general manager of Investment. The aim is to enhance the asset manager’s international presence, increasing its visibility in line with its global management mission, as regards both its geographical presence and the range of products and services it offers.

These changes form part of the Group’s strategic plan, designed to increase the know-how, collaboration and capabilities of our teams who are specialists in investing on the international stage.

MAPFRE AM seeks to help clients build up their savings by providing specialist knowledge and advice. “The goal is that, in the long term, they can maintain, or even increase, their purchasing power and thus satisfy their needs or fulfill their desires,” points out Luis.

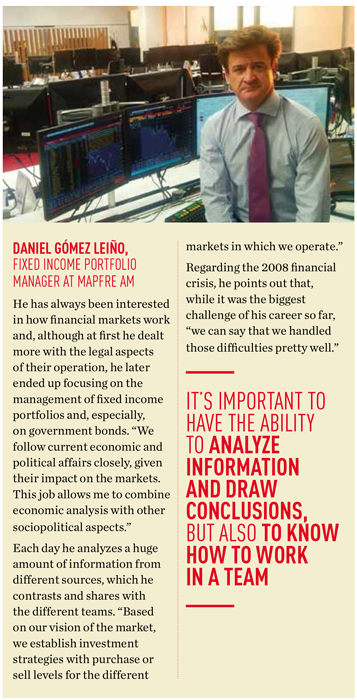

Beatriz and Daniel are Fixed Income portfolio managers. Their work primarily consists in managing the financial resources of both the Group and those of their clients, always striving to achieve the maximum return, seeking the best alternatives in each market context, with an eye on the medium and long term prospects, and in line with the constraints laid down in our investment policies. “We’ve been through a lengthy period of low interest rates and a certain degree of complacency, supported by the central banks. This was a tough time as regards searching for yields and we now have to relearn how to stand on our own two feet, but we will continue striving to provide our clients with products tailored to their risk profiles,” says Beatriz.

Cristina manages Equity portfolios, in particular she focuses on investments in the shares of listed European companies. Luis is a mutual fund manager. He believes that the greatest challenge at present is the quest for new ways to generate attractive returns in an increasingly competitive environment, where the yield from fixed income, the traditional investment of insurers, is at historic lows. “In our company, thanks to an excellent solvency position and the fine work of our colleagues over the past few years, we have room to diversify our investment portfolio a little, increasing the relative weight of equity and alternative investment products, without ever losing sight of our prudent long-term approach,” he explains.

Before making an investment decision, a detailed analysis of the company is undertaken with the support of both internal and external models. In addition, account is taken of market conditions and those criteria approved by the Investment Committee, such as the distribution of assets.

It is precisely this in-depth analysis of companies from different sectors that Cristina enjoys most in her work. “The most satisfying thing is when you realize you’ve come across a company undervalued by the market,” adds Luis.

In an increasingly competitive environment, our leading actors undergo a process of continuous training that enables them to keep growing as professionals. Such transversal training facilitates the functions related to the Investment area being carried out in a similar fashion in every country where MAPFRE has a presence.

As in all sectors of society, the new technologies are the driving force behind the development of the Investment area, modifying the digital access and multichannel options, and the way we communicate with our clients. Moreover, the new MiFID II and Solvency II regulations, as well as client protection, are key issues and are already challenges that the investment sector worldwide will be facing for the next few years. “We must innovate so as to offer alternative products and, at the same time, remain highly rigorous in our selection of risk assets,” remarks Cristina.

When asked what qualities people need to be able to do their job, they all agree that teamwork is essential, in addition to constant training and tremendous powers of concentration. “What is needed is analytical thinking, responsiveness and, also, serenity,” concludes Beatriz.

MAPFRE INVERSIÓN’s priority for the coming years is to stick to its conservative, minimum-risk investment policy, while, at the same time, continuing to create value for our clients, whether participants in mutual funds or MAPFRE companies, adapting to deal with an ever-changing market, in which technology will play an increasingly relevant role.