Appraisers fulfill one of the most important tasks in our sector: they analyze the causes of the incident, assess the consequences and provide the company’s commitment to quality. MAPFRE has 1,094 appraisers around the world and, in this report, five of them offer us more details of their important work.

TEXT Andrea Burgui | ILLUSTRATIONS Thinkstock

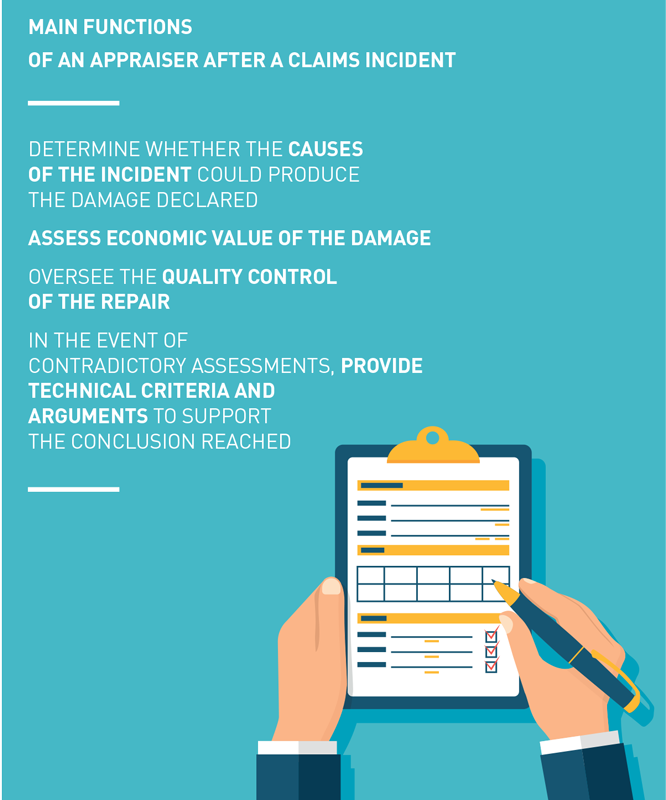

The work of the appraiser is essential and can be a differentiating factor in an insurance company. Performed by experts, it ranges from analyzing the causes of the incident through to the quality control and follow-up of the case, where MAPFRE’s commitment to quality stand out. This therefore is one of the most important procedures within our industry and, of course, our company.

Currently, the profession of insurance appraiser has the following specialties:

• Auto and pleasure craft insurance

• Fire and other risk insurance

• Agricultural Insurance

• Medical insurance

MAPFRE has 1,094 appraisers distributed around the world. They are the interface between customers and the company, working every day to achieve a fair, top quality outcome for all the parties involved following a claims incident. And what exactly does this entail? To find out more about this function, in this article we relate the experiences of five MAPFRE appraisers.

They are professionals who not only possess technical knowledge of their particular field, but they must also know the terminology and common practices of insurance contracts, as well as understand and deal with the applicable regulations.

Noelia Rodríguez, an auto appraiser in Spain, tells us that her work “is highly dynamic, with a great many different tasks to complete throughout the day”, all related to investigating and analyzing the causes of the incident, evaluating the damage, and defining the circumstances that determine the indemnity settlement. In addition, Natalia Serrano, head of agricultural indemnities and appraiser in Colombia, stresses that it is always necessary “to look beyond what is being asked of you,” with constant monitoring of procedures and processes according to the figures you obtain.”

MAPFRE appraisers approach their work with enthusiasm and commitment. Lucilo Jiménez, auto insurance appraiser in the Dominican Republic, tells us that becoming an appraiser was “a dream come true. Each day I start my work enthusiastically, striving to offer the best service so as to achieve the satisfaction of the customer and the company.”

Rodrigo Duarte, an auto appraiser in Paraguay, also considers customer satisfaction to be one of his priorities and says he feels fulfilled with his daily work which he describes as “different every day”. Tania Domínguez, a medical appraiser in Nicaragua, coincides with her colleagues in stating that her commitment and dedication “have opened doors for me throughout my professional career, which I love”.

The appraisal profession is habitually associated with people who are objective, impartial, thorough and, above all, fair.

However, in addition, appraisers must be people with ease of communication, people skills and a great deal of empathy, since they have to mediate between the different parties involved. As a medical appraiser, Tania has to deal on a daily basis with people

with health problems, which obliges her to “demonstrate my human side in difficult situations with customers.”

A quality that is not limited solely to those working with the health sector. For example, Natalia recognizes that her eight years as an agricultural indemnity appraiser have afforded her “a lot of character and maturity” in the face of very different challenges, as she is often faced with “very difficult topographic conditions and access to the farms.” Leaving the office and putting herself in the customer’s shoes helps her to be aware of their needs.

For his part, Lucilo affirms that what he most enjoys about his work “is seeing the smile o every customer’s face when they get their vehicle back after an accident in perfect condition.”

Like the vast majority of sectors, the appraisal world is also being digitized, and this is seen as an advantage by our protagonists. For Lucilo, digitization places “a whole range of possibilities within our reach,” which facilitates fraud detection, parts management and issuing repair orders in a shorter period of time. Something that Natalia confirms and, moreover, she also points out that the “technological tools will enable us to simplify our work,” they will help them to “anticipate situations of risk” and anticipate customer needs. As for Rodrigo, just like his colleagues, he believes that the digital tools “will help us optimize times, which will make the whole appraisal process easier.”

An example of this are the scanned images already used by MAPFRE auto appraisers in Spain, which are integrated into the digital claims files and facilitate the identification of the parts to be replaced, automatically informing of their cost. In seconds, they assess the damage to the vehicle and analyze the cost of the spare parts and repairing the car.

Training, essential for the appraiser’s work

As we have seen, an appraiser must be able to understand the terminology and common practices of insurance contracts, as well as know the applicable regulations. And this is not easy, given the pace at which things change these days. In this context, training is an essential element for the work of the appraiser.

In the case of Tania, she stresses that being a medical appraiser requires her to update her expertise “on studying each case she receives” and it is essential to be aware of all developments in the sector to guarantee customers the best service possible. Noelia, for her part, points out that “the demands, pace and expectations of society and the companies call for appraisers adapted to meet those needs and changes, embracing the technological innovations.” For this reason, the appraiser training offered by CESVIMAP is geared toward those who wish to pursue a career in this sector, but also to those wanting to broaden the scope of, and update, their knowledge base.

For Rodrigo, it is essential that this training should include “the keys to performing correctly in the realm of human relationships with providers and customers,” and thus facilitate the handling of certain situations that may arise when verifying a claim, such as possible fraud.

Although they are from very different parts of the world, the protagonists of this number agree that their work provides them with new challenges and development opportunities every day. This calls for great commitment and dedication, but also guarantees innovation, improvement and accountability